22 Mar

Facing a Railway Strike- How Rail Customers Can Mi...

With Canada on the brink of a national railway shutdown, rail users face huge losses. This detailed report shows rail customers what to expect and how to mitigate their risks.

08 Feb

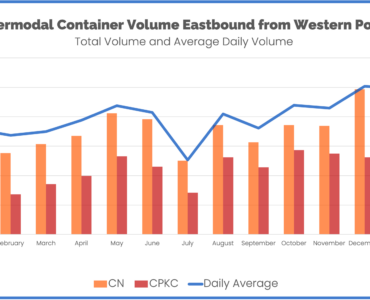

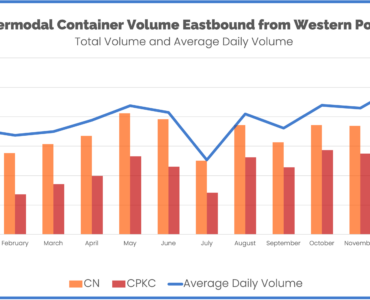

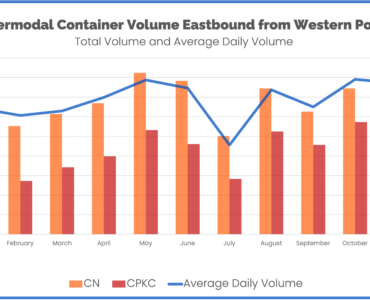

Canada Intermodal Rail Volume Report: January 2024

Total average daily volume headed eastbound from the Western Canada ports declined 1.7% in January compared to December.

08 Feb

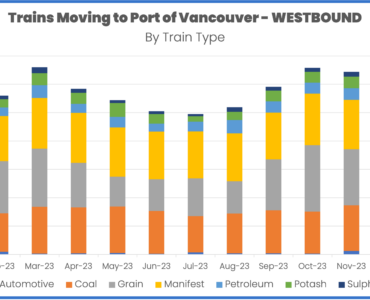

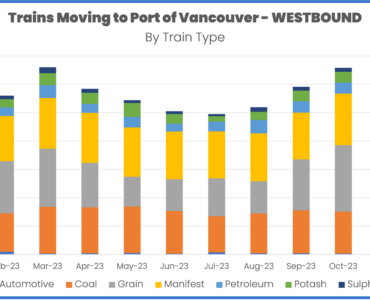

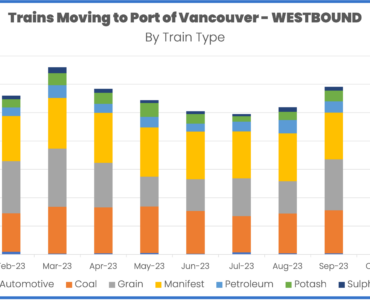

Canada Ports Rail Volume Report: January 2024

Total train volume westbound to the Port of Vancouver dropped 12.9% in January compared to December. Part of this is from a decrease in train volumes in the middle of January caused by the extreme cold.

24 Jan

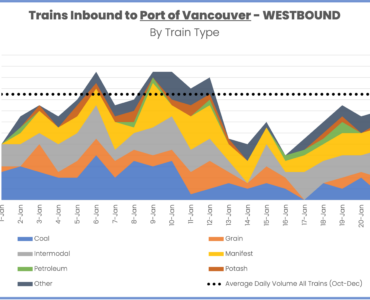

Extreme Cold Snarls Rail Movements Throughout West...

Record low temps lead to reduced train volumes and smaller trains. Traffic inbound to the Port of Vancouver suffered the greatest impact.

11 Jan

Canada Ports Rail Volume Report: December 2023

Total train volume westbound to the Port of Vancouver declined 4.0% in December compared to November. Sulphur unit trains increased the most, growing from 17 trains to 22 trains. The largest decrease came from Grain unit trains, which declined 19.2%

11 Jan

Canada Intermodal Rail Volume Report: December 202...

Average daily volume of international intermodal containers headed eastbound from the Western Canada ports grew 17.4% in December compared to November.

14 Dec

Canada Ports Rail Volume Report: November 2023

Total train volume westbound to the Port of Vancouver declined 3.5% in November compared to October. Automotive trains increased the most, growing from 4 trains to 12 trains. The largest increase in train counts were Coal trains, which grew from

14 Dec

Canada Intermodal Rail Volume Report: November 202...

Total average daily volume headed eastbound from the Western Canada ports dropped 2.3% in November compared to October.

15 Nov

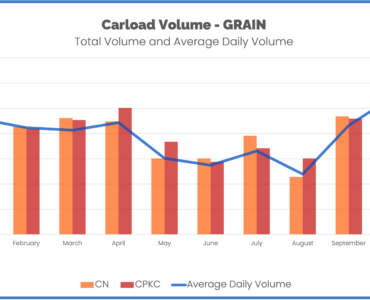

Canada Rail Volume Report: Commodities October 202...

Overall grain carloads rose 27% in October, after a huge 75% increase in volume in September. Carloads on CN increased 21% from the prior month and carloads on CPKC increased 33%. CPKC moved more grain carloads than CN last month

13 Nov

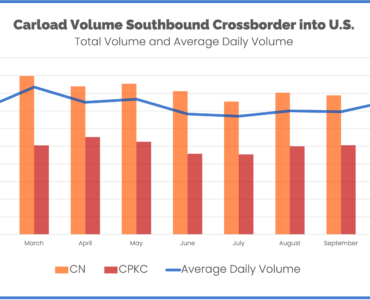

Canada Rail Volume Report: Crossborder October 202...

Southbound rail volume into the United States increased in October after two months of flat volume. Total carload volume grew 5.8% in October. CN’s southbound volume dipped 2.5% while CPKC had a large increase of 18.1%.